Carousel content with 3 slides.

A carousel is a rotating set of images, rotation stops on keyboard focus on carousel tab controls or hovering the mouse pointer over images. Use the tabs or the previous and next buttons to change the displayed slide.

The American College of Environmental Lawyers (ACOEL) is a professional association of distinguished lawyers who practice in the field of environmental law.

The American College of Environmental Lawyers (ACOEL) is a professional association of distinguished lawyers who practice in the field of environmental law.

Our members are dedicated to: maintaining and improving the ethical practice of environmental law, the administration of justice, and the development of environmental law through rigorous focus, outreach and education in all forums – federal, state, municipal, tribal and international. Membership is by invitation and members are recognized by their peers as preeminent in their field.

Recent Blogs and News

from ACOEL

Tony Bennett may have left his heart in San Francisco but the City’s appeal of its NPDES permit is on its way to the United States Supreme Court

Posted on April 18, 2024 by Jeff Porter DOJ and EPA have submitted their brief arguing that the Supreme Court should leave alone a split Ninth Circuit decision upholding…

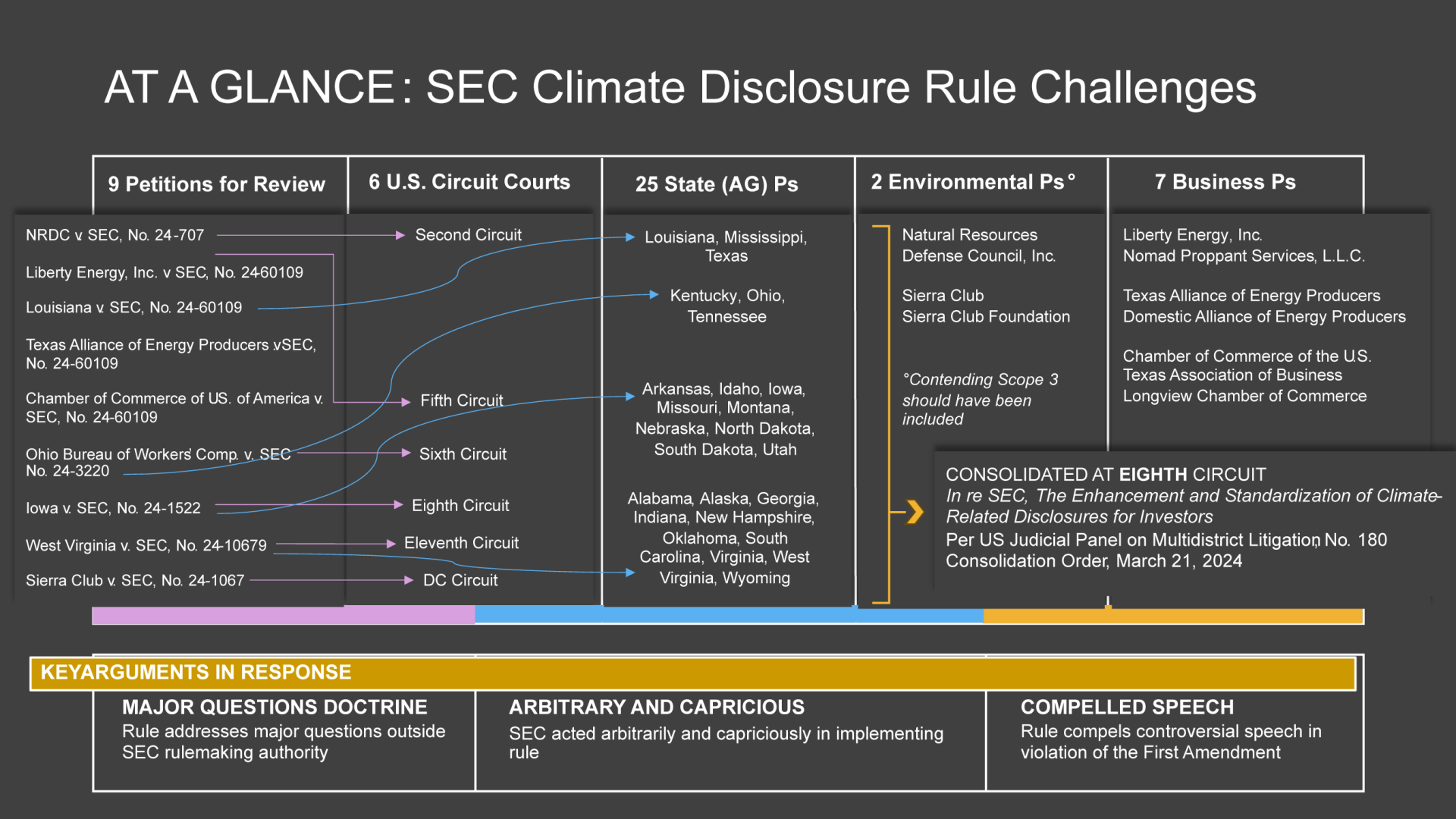

AT A GLANCE: SEC Climate Disclosure Rule Challenges

Posted on April 10, 2024 by Bessie Daschbach On March 6, 2024, the U.S. Securities and Exchange Commission (SEC) issued its long-awaited climate disclosure rule. The rule, formally titled,…

Superfund Is Short of Money. Can It Be Fixed By Tinkering Around the Edges?

Posted on April 2, 2024 by Seth Jaffe Last week, Inside EPA (subscription required) ran a story indicating that EPA is trying to figure out how to juggle some…

Subscribe to the ACOEL blog

Welcome to New Members

ACOEL is pleased to congratulate and welcome its 2023 class of 27 new Active Fellows, representing a diverse group of preeminent practitioners from around the United States.

Welcome to our new members in the class of 2023!

Upcoming Events

some description text.

Our Sponsors

Babst, Calland, Clements and Zomnir, P.C.

Babst, Calland, Clements and Zomnir, P.C.

Baker Botts LLP

Baker Botts LLP

Bergeson & Campbell, P.C.

Bergeson & Campbell, P.C.

Bond, Schoeneck & King PLLC

Bond, Schoeneck & King PLLC

Bracewell LLP

Bracewell LLP

Bradley Arant Boult Cummings LLP

Bradley Arant Boult Cummings LLP

Crowe & Dunlevy

Crowe & Dunlevy

Culp & Kelly, LLP

Culp & Kelly, LLP

Earth & Water Law, LLC

Earth & Water Law, LLC

Farella Braun + Martel LLP

Farella Braun + Martel LLP

Greenbaum, Rowe, Smith & Davis LLP

Greenbaum, Rowe, Smith & Davis LLP

Greenberg Traurig LLP

Greenberg Traurig LLP

Hangley Aronchick Segal Pudlin & Schiller

Hangley Aronchick Segal Pudlin & Schiller

Haynes and Boone, LLP

Haynes and Boone, LLP

Hinkle Shanor LLP

Hinkle Shanor LLP

Hinckley Allen

Hinckley Allen

Holland & Hart LLP

Holland & Hart LLP

Hollingsworth LLP

Hollingsworth LLP

Kaplan Kirsch & Rockwell LLP

Kaplan Kirsch & Rockwell LLP

Kazmarek Mowrey Cloud Laseter LLP

Kazmarek Mowrey Cloud Laseter LLP

Kelley Drye & Warren LLP

Kelley Drye & Warren LLP

King & Spalding LLP

King & Spalding LLP

KLAC Law LLC

KLAC Law LLC

Manko, Gold, Katcher & Fox LLP

Manko, Gold, Katcher & Fox LLP

Marten Law PLLC

Marten Law PLLC

McLane Middleton

McLane Middleton

McMahon DeGulis LLP

McMahon DeGulis LLP

Mitchell Williams

Mitchell Williams

Modrall Sperling

Modrall Sperling

Moore & Van Allen

Moore & Van Allen

Nijman Franzetti LLP

Nijman Franzetti LLP

Perkins Coie

Perkins Coie

Robb Water Partners

Robb Water Partners

Shook, Hardy & Bacon

Shook, Hardy & Bacon

Sidley Austin LLP

Sidley Austin LLP

Spencer Fane

Spencer Fane

Steptoe & Johnson PLLC

Steptoe & Johnson PLLC

Stoel Rives LLP

Stoel Rives LLP

Troutman Pepper

Troutman Pepper

Vinson & Elkins LLP

Vinson & Elkins LLP

Warner Norcross + Judd

Warner Norcross + Judd

Warren Environmental Counsel LLC

Warren Environmental Counsel LLC

WilmerHale

WilmerHale